You don’t know what you’ve got till it’s gone – or gets super expensive, notes equity investment specialist Michael Cumberlidge. Demands on our electricity grids are going to grow rapidly in coming years, so we need to invest in them now.

An electric future

From checking our phones and firing up our laptops, to getting in the car or the train to work, energy, in all its forms, is the lifeblood of our society. And just as we only think about our circulatory system when things go wrong, we often take energy for granted until it’s not there.

Think back to 2022 when Russia launched a full-scale invasion of Ukraine, upending global energy markets. Already strained by high demand, prices for oil and gas skyrocketed. European nations suddenly had to reconfigure their energy strategies to drop one of their most important energy partners. It was painful – here in the UK we’re still paying extraordinarily high power bills years later as this rupture works its way through our market.

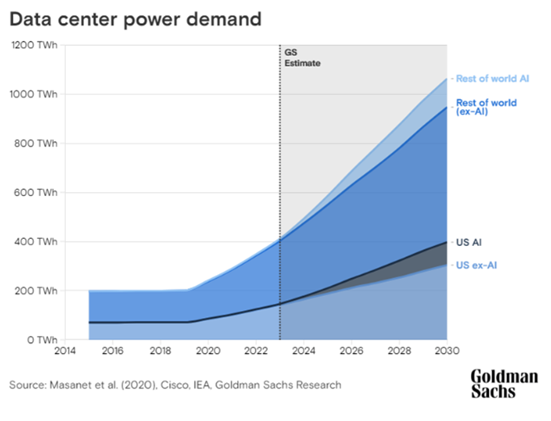

Our energy system faces numerous challenges today, which are arguably more pressing than at any time since the 1970s. The amount of electricity we use is forecast to grow rapidly, both here in the UK and around the world. Much of this is due to efforts to reduce carbon emissions and mitigate climate change. But according to a report by investment bank Goldman Sachs, the single biggest driver of electricity growth over the eight years to 2030 will be data centres, the huge warehouses of computers that power cloud computing. They currently account for just 3% of US demand. Goldman Sachs predicts that will more than double to 8% by 2030.

Here in the UK, electricity generation and usage have fallen 12% and 18% respectively since 2000 (the extra energy generated is now exported). That’s despite our population growing 13% and the rise of mobile phones, wearables and the internet over that time. Our electricity simply goes so, so much further than it used to. However, Goldman thinks these efficiency gains could be severely blunted by the massive power demands of an AI age. As an example, US internet giant Alphabet says it takes 0.3 watt-hours to generate a response to a Google query. ChatGPT uses roughly 10 times as much power.

Finding efficiency

We’re also expecting a surge in AI usage and therefore a surge in the electricity to power it, and that means we need efficiency gains in electricity more than ever. From what I’ve written so far, it would be easy to believe that we’re scratching around in the bottom of the biscuit tin for the last crumbs of available energy. Surprisingly, we waste a huge amount of energy each year, partly through an inefficient grid and outdated hardware. Finding efficiencies in our energy system is essential to energy security and price stability. By introducing new technologies into companies and our homes we can reduce the volume of wasted energy.

Our Rathbone Greenbank Global Sustainability Fund owns German electrical engineer Schneider Electric, whose business helps solve energy waste. Schneider has a comprehensive portfolio of energy efficiency and renewable technologies. These include utility grid automation, fail-safes for keeping mission-critical power running, and energy storage. Schneider also has a strong digital business. Its software seeks to ensure the smooth operation of smart grids that allow households and businesses both to receive power and to give surplus supplies back to the market. The software also enables better storage, monitoring and conservation of energy. Schneider products also eliminate the risk of human error through automation and digital energy monitoring. We believe these tools will be crucial for developing next-generation power infrastructure.

From flat to frenetic

Annual growth in US power demand was flat for the past decade. But this is set to change: Goldman Sachs forecasts American electricity use will ramp up 2.4% each year for the next eight at least. Data centres currently under construction in the US will require almost 2,312 megawatts of energy; the same amount could power over 2 million homes.

Power demand continues to grow across the globe, with developing nations now driving much of the increase in energy use. But despite growth in demand, hundreds of millions of people still have little or no access to electricity – 775 million, the International Energy Agency estimates.

To support this increasing demand for power, the world needs to invest in extensive infrastructure, from generation to transportation and storage. That sounds like a fantastic investment opportunity. But while it is, it does come with a good share of risk.

It’s often challenging for sustainable investors to put money into the energy sector. Direct investment in renewable energy companies is a tricky business, as they are often smaller businesses with greater risks. This can reduce their negotiating power when dealing with suppliers and customers. That makes them susceptible to rising costs because they find it difficult to raise their own prices. That squeezes profit margins. Other risks stem from the long-term nature of this industry: it often takes years if not decades for a project to go from planning and regulatory scrutiny to construction and connection to the power grid itself. That’s a long run of costs before you start to see any money through the door.

Our Rathbone Greenbank Global Sustainability Fund has found a way to invest in this sector that we believe should be less risky. Quanta Services is a US-listed infrastructure outsourcer, specialising in building and maintaining assets for owners of big, complicated assets. It focuses mostly on energy plants and electricity grids. Because problems with this sort of infrastructure tend to cause mayhem contracts are generally long-term and recurring, so that workers understand the equipment and therefore minimise mistakes and confusion. We think the market for this sort of work should grow significantly in the coming years as the US rejuvenates old assets and invests in cleaner energy generation.

These projects and contracts also require specialised knowhow and highly skilled and qualified workers. To develop an edge over its rivals, Quanta is investing in increasing its roster of skilled staff. A few years back it even bought a skills college to teach more people the skills required for its industry. Quanta increased its investment in training and safety by $150 million and offered skills training to 30,000 more people in 2023 than the previous year. This is good for Quanta, which needs trained staff to carry out its contracts. It’s also good for all those people who win entry into a well-paid trade.

We think companies like Quanta and Schneider are vital for building and maintaining the infrastructure we need to power a more environmentally conscious future. More than half of UK electricity came from zero-carbon sources in 2023 according to National Grid (14% came from nuclear energy, the rest renewable). Our cousins across the pond achieved 40%, with 19% provided by the atom.

A carbon-free energy system is still years if not decades away from becoming a reality, but companies like Quanta Services and Schneider are helping us get there.