Fund managers from Rathbones Asset Management set out their views for 2025

2025 Outlooks

Article last updated 20 December 2024.

- Alexandra Jackson, Rathbone UK Opportunities Fund

- James Thomson, Rathbone Global Opportunities Fund

- David Harrison, Rathbone Greenbank Global Sustainability Fund

- Bryn Jones, Rathbone Ethical Bond Fund, Rathbone Strategic Bond Fund, Rathbone Greenbank Global Sustainable Bond Fund

- Stuart Chilvers, Rathbone High Quality Bond Fund, Rathbone Greenbank Global Sustainable Bond Fund

- David Coombs & Will McIntosh Whyte, Rathbone Multi-Asset Portfolios and Rathbone Greenbank Multi-Asset Portfolios

- Alan Dobbie & Carl Stick, Rathbone Income Fund

Alexandra Jackson, fund manager, Rathbone UK Opportunities Fund

The US election and UK Budget have helped solidify confidence in American exceptionalism. A President focused on deregulation, tax cuts and putting America first set against a Prime Minister intent on raising the tax and regulatory burden on British businesses. The immediate outcome is evident in the relative returns and valuations of US stocks versus their UK counterparts. The S&P 500 was up almost 30% this year to 30 November, compared with the FTSE 250’s 8.7% gain. Now, the former is trading at a price-earnings multiple almost double that of the latter. In the very near term, there’s no reason to expect the US juggernaut to stall.

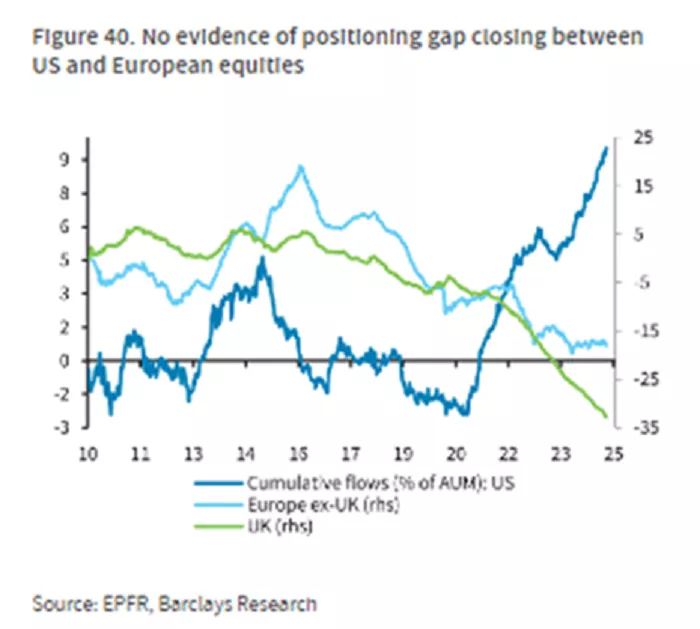

But we know clients worry about how all this could play out over longer timeframes. After spectacular returns, leaving heady valuations, and massive over-crowding in US large caps, the risks could be building. Scary tariff-related headlines, or earnings misses in the Magnificent Seven tech stocks at the top of the S&P 500 become much harder to stomach at these lofty heights. What’s the alternative? The political and economic situation in Europe is worsening day by day. The data out of China remains largely impervious to disappointing stimulus. And tariff risks abound.

UK assets may offer a way to thread this particular needle in 2025. There’s a lot to like: a huge valuation discount to cushion against volatility, a markedly lower tariff risk than other countries, and the possibility of lower energy costs, which would be particularly beneficial for the UK economy. Our macroeconomic readings compare well with other global markets and politically the UK looks like an island of calm against several others. We’re no longer the economic or political outlier, far from it, yet valuations still suggest this. Sterling is often seen as the ‘PE multiple’ on UK PLC, and this chart shows how it has held its own against the dollar, unlike its peers.

When, like now, there are so many variables at play, positive earnings momentum is often the factor that performs best. We are focusing our efforts here and this keeps us largely in the FTSE 250, seeking out our global niche businesses with financial metrics that match larger US peers.

Sound advice often warns us not to put all our eggs in one basket. The US right now may look like the strongest, prettiest basket. But diversification is the cornerstone of long-term wealth creation. With Trumped-up valuations vulnerable to noise, and disarray in the rest of Europe, sensible British compounders at record-low valuations look like an interesting diversifier.

James Thomson, fund manager, Rathbone Global Opportunities Fund

Markets up, yields up, inflation up, debt up and the dollar up. The re-election of Donald Trump as President and a Republican sweep of Congress ushers in a new era of investing – a pro-growth ‘America First’ agenda potentially littered with inconsistencies and unintended consequences down the road.

In the short term, it’s all sugar and no vegetables, but markets may sour to that taste over the longer term. Fear of missing out on gains will cause even sharper divergence in the performance of perceived winners and losers in the months ahead as investors crowd into the ‘Trump trade’ and out of Trump losers. The problem is that Trump’s passions are fickle. Mania may evaporate for stocks deemed to benefit from regulatory rollbacks, uninhibited M&A and big tariff increases that manage to somehow avoid causing a trade war. To mitigate the impact of upcoming ‘whack-a-mole markets’, we want to maintain balance and diversity by sector, demand drivers and growth volatility. But in the short term, investor giddiness will continue as a wave of liquidity goes into US equities.

Bull markets are derailed by recessions, irrational exuberance, or an uncooperative Federal Reserve. None of these are in evidence at the moment, so the bull market will likely continue.

This year delivered a healthy return and certainly better than many of the bears expected at the beginning of the year. While markets have been a little choppy throughout, don’t let the noise drown out the true message: we don’t think we’re on the cusp of a prolonged bear market. In fact, the long-term future looks bright and we’ve been buying.

We’ve benefited from stocks like high-end computer chip designer Nvidia, search giant Alphabet and office software king Microsoft, all of which we’ve owned for over five years; Amazon for 15 years; and we finally bought iPhone maker Apple in the sell-off of ‘growth’ stocks in 2022. These members of the Magnificent Seven did well for us, but our machine-driven competitors (the tracker funds) did even better as they don’t have the discretion to take profits or manage the risk of large position sizes. To put this risk, passively taken, into context, the Magnificent Seven tech companies astride the S&P 500 make up almost 35% of the entire index. Now, these are great companies – most of which we own – but putting more than a third of a stock portfolio into fewer names than you have fingers is a big gamble.

We’ve banked much of the stratospheric gains we’ve achieved in Nvidia over the year to date. We have managed our position size and risk by selling roughly three-quarters of our holding over the past two years and using that cash to buy new holdings that will be the success stories of tomorrow – some I’ll talk about, others I won’t.

While market-wide returns were concentrated in a small group of mega-cap stocks, I’m pleased that our key drivers have come from a broad church. Our top performers this year include Nvidia, of course, discount retailers Costco and Walmart, med-tech company Boston Scientific and robotic surgery business Intuitive Surgical. These companies have the star quality that we look for in a growth stock: innovation, a protected competitive position, resilience, adaptability, scale and strength.

We believe we are well placed to participate in a continued rally, but we’re staying soberly diversified. Our US weighting is over 70%, an all time high, and we benefit from a strengthening dollar. Our tech stocks, industrials and financials (albeit no banks) benefit from the ‘Trump bump’, offset by our interest rate-sensitive housing names (e.g. Home Depot) and weatherproof stocks (e.g. Coca-Cola and McDonald’s) which have been shunned in this ‘risk-on’ market.

David Harrison, fund manager, Rathbone Greenbank Global Sustainability Fund

The future seems like it’s racing towards us faster than ever. As populations age and the world becomes more complex, we need to adopt new technology to keep progressing and improving people’s lives. While the news can often seem atrocious, beneath the headlines are countless advances in the tools and technology that should benefit us all and help to address the challenges we face. To capitalise, however, we need to invest in the infrastructure that will support these crucial new tools. We think there are three distinct of development, and we’re excited about their prospects for the year ahead.

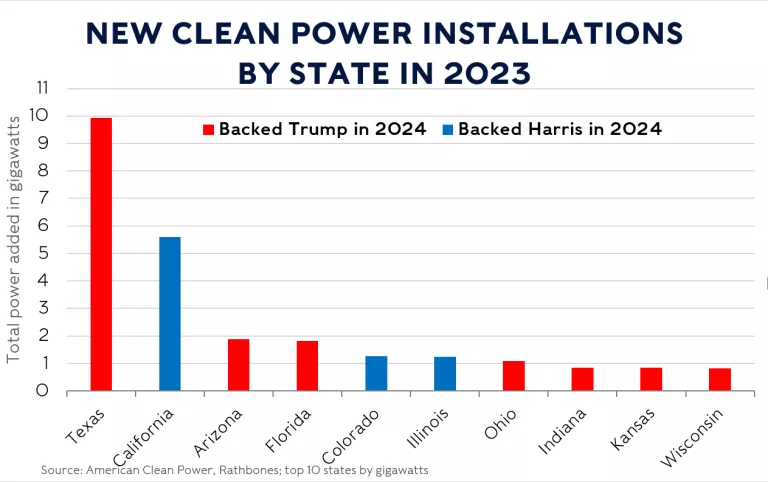

The first is physical infrastructure. We think the energy transition from carbon-heavy fuels to cleaner and cheaper alternatives will continue to accelerate, despite new President Donald Trump’s rhetoric. In short, it benefits his base too much for him to completely kibosh it (see chart). Investment in electricity grids, coupled with emerging technologies in energy storage will be positive for businesses such as Schneider Electric and Hannon Armstrong, both of which we own.

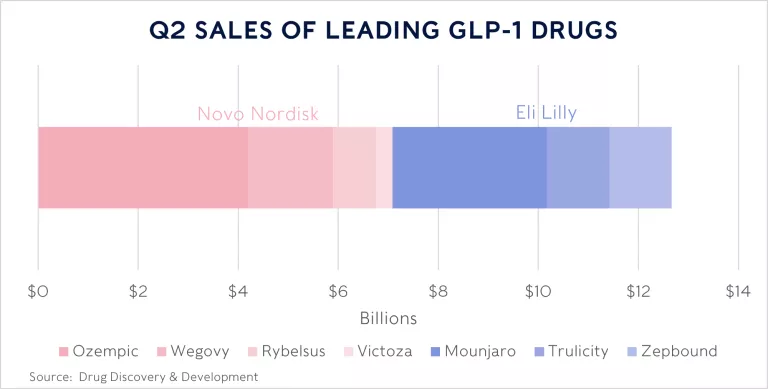

The second type of infrastructure is health and wellbeing and medical innovation. It’s hard to look past the opportunity to combat obesity and diabetes presented by next-generation weight loss and diabetes management drugs. These drugs, which mimic a gut hormone called GLP-1 (glucagon-like peptide), are shaping up to be important and revolutionary new tools for combatting one of the greatest health challenges of our time. Two firms dominate these drugs: Denmark’s Novo Nordisk (which we don’t own) and America’s Eli Lilly (which we do).

The third type of infrastructure is digital: the data centres, software platforms and connections that will boost global computing power yet further. The sheer scale of the AI opportunity remains compelling to us. We need to keep close watched, however, as the gargantuan size of the market’s growth – even between quarters – brings immense volatility, both up and down. However, businesses such as high-end computer chip designer Nvidia or chip design tool developer Cadence Design Systems are likely to remain critical cogs in this expansion. We believe they should be beneficiaries for the long run.

Our portfolio positioning has remained consistent since the beginning of the year, but we have started to increase our exposure to companies whose prices are more sensitive to changes in interest rates. A good example is our purchase of American Tower.

American Tower provides critical digital infrastructure through its ownership of cell towers around the world (but predominantly in the US). This is a well-run and highly cash generative business with a proven record of increasing its sales and profits. The shares were hurt as US rates rose, making its valuation extremely attractive to us. We think the global rate cycle has peaked and rates will steadily fall from here. If we’re right, a business such as American Tower should benefit.

We also gradually increased our exposure to several small and mid-cap companies that we already held. In many cases, these high-quality franchises were penalised for not being ‘mega-cap’ stocks in the first half of 2024. We saw some extremely attractive valuations appear. Again, we believe these hidden gems will also benefit as rates fall.

Bryn Jones, fund manager, Rathbone Ethical Bond Fund, Rathbone Strategic Bond Fund, Rathbone Greenbank Global Sustainable Bond Funds

Rathbone Ethical Bond Fund

The path for UK interest rates is uncertain. If we look at the G7 economies, most have cut rates. But the UK has not been aggressive in cutting rates, with just two quarter-percentage-point reductions as the year winds down. Our unemployment rate is low by historical standards (although we note the data issues plaguing the ONS Labour Force Survey) and inflation, while bumpy, does appear to be in check. So we think the Bank of England won’t be as aggressive as perhaps some other central banks, yet the path of rates is still downwards although we expect some caution from the BoE as they wait to assess the impact from the Budget.

There’s been a huge amount of demand for a high volume of new issues coming to market, while trading afterwards has also been quite robust. Credit spreads (the extra return above government bonds to compensate for the chance of default) have tightened significantly through the year despite the a few brief periods of widening (French elections, manic Monday etc.): as we approach year’s end most measures of spread are at multi-decade lows.

This fall in credit spreads has been somewhat tied to the monetary policy of the US Federal Reserve (Fed). Every time a Fed meeting looms where an interest rate cut was expected spreads tightened. And when the Fed didn't deliver through the summer and the early part of the autumn, credit spreads rose.

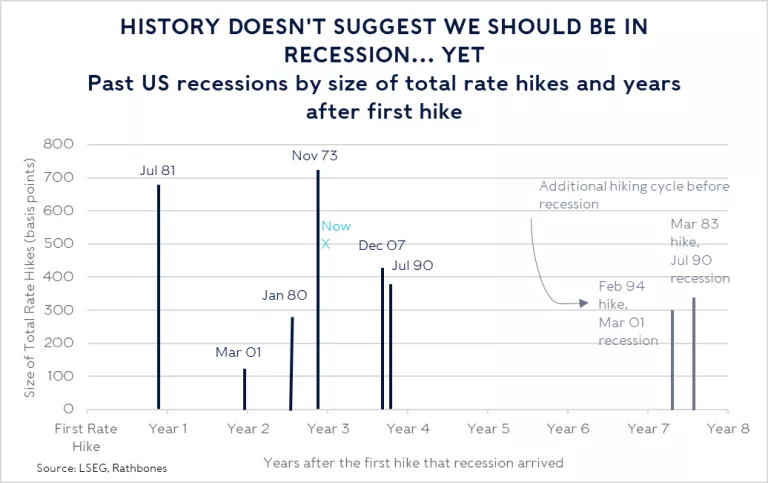

The big risk to this run of performance is recession. The probability of a downturn increases when you've had interest rate hikes (and remember it was one of the sharpest hikes in rates on record). Historically, periods of rate hikes – 1980, 1977 and 1994, for example – have caused a subsequent recession. The length of time between the first hike and the recession varies widely, yet we're entering that potential danger zone now: it’s been two years and nine months since the UK and the Fed first hiked and almost 18 months since they stopped.

And so recession could be a possibility in 2025. But it’s all based on a few factors: you need to see unemployment rise, you need to see wage inflation disappear, and you also need to see excess savings evaporate. Sometimes people say, “Well, we can borrow out of this,” but I think most US households and corporates can't this time. Interest rates are much higher than anyone has been used to for several decades and credit card interest rates are at an all-time high. Federal Reserve data shows the average credit card attracts a 23.4% rate (previously it’s never been above 16.5%). I think the economic momentum of the US really is based on employment at the moment. Markets are reacting to employment data quite significantly because it’s the last pillar that holds up the economy. If employment was to crack, then it becomes a self-fulfilling prophecy that we would get a recession, which would flow out to the rest of the world. Perhaps we will get a soft landing or a shallow recession, but remember: to get to a hard recession or a hard landing, you have to go through a shallow one first.

As for the UK, we’re still recovering from the mild recession of the second half of 2023. There’s a chance of a double-dip recession, as growth has faded as 2024 progressed and we fear the changes announced at the budget could negatively impact employment. Yet there are also reasons to expect some resilience. UK savings rates have remained pretty strong and the housing market has been remarkably buoyant. If consumer confidence keeps rising, there could be a resurgence in household spending.

In the meantime, with inflation generally in check, rates should continue to fall gradually in the UK. If so, that should boost bond prices.

Rathbone Strategic Bond Fund

Towards the back end of 2024 we increased the defensiveness of our fund. We have reduced our exposure to high yield as credit spreads have tightened to extremely low levels. They are now at a point where, generally, we don’t feel we’re being compensated for the risk, particularly as we expect the high absolute level of interest rates to pressure company fundamentals (particularly interest coverage) as maturing bonds are refinanced at higher rates. We think this could drive an uptick in the number of fallen angels in 2025 – investment grade businesses demoted to high yield by ratings agencies.

We have increased our exposure to government bonds. While the policy outlook for next year is uncertain, we think this is fairly reflected in current market expectations. We think there’s a chance that growth will disappoint, which would mean central banks making more aggressive rate cuts than currently priced. That should benefit government bonds most.

While credit spreads are tight in investment grade credit, we are still finding value in relatively short-dated, subordinated financials. These provide us with attractive levels of carry and keep our spread duration limited, and hence should help to limit price falls in the event of significant spread widening.

Given the unclear outlook for the year ahead, we think the flexibility to be able to swiftly alter our positioning throughout 2025 will prove very valuable.

Stuart Chilvers, fund manager, Rathbone High Quality Bond Fund and Rathbone Greenbank Global Sustainable Bond Fund

Rathbone High Quality Bond Fund

I think UK interest rate cuts will continue from here, but would caution that it may take some time for them to filter through. To my mind that means the Bank of England (BoE) continuing to cut by about 25 basis points a quarter. The BoE is also likely to err on the side of caution in the near term given the uncertainty the Budget created, as it waits to see how some of the government’s changes impact the economy early next year. I think there’s a risk that the combination of increases to Employer National Insurance and the minimum wage could hurt employment by more than we expect, which means the pace of rate cuts could accelerate towards the back end of the year.

I expect headline inflation to pick back up marginally in 2025, but core inflation should continue its slow grind lower, driven by a slow yet steady move lower in services inflation. However, the recent 6.7% increase to the UK minimum wage as well as the increase to National Insurance is a potential risk to this, however, so I remain watchful.

For credit spreads (the extra return above government bond yields to compensate for the risk of default), we think there could be slightly more challenging times ahead. Spreads are at multi-decade lows and I would expect them to widen on any indications of economic weakness, although I think that may simply encourage investors to move their money from money market funds to fixed income as yields become more attractive as central bank interest rates fall. This phenomenon could help keep spreads tight.

That being said, given the high-quality and short-duration nature of this fund, we would expect the price impact of any widening to be relatively limited. With the yield on offer from these bonds, we feel we are being compensated for the risk being taken here.

Rathbone Greenbank Global Sustainable Bond Fund

Sustainable-labelled issuance, on the whole, was strong in 2024. There was comfortably more than $500 billion of bonds sold in the first half of the year, and as we reach year-end it looks like 2024 will be just the second year ever that tops $1trn. It may even exceed 2021’s record level of $1.003trn. Green bond supply hit a record high for the first six months of the year at $368bn.

While most of these sustainable-labelled bonds were issued by nations, supranationals and agencies, $181bn was from corporates which was a 5% drop year on year. But there’s a notable distinction between regions. Within Europe, €117bn was issued in the first half, which is the highest H1 figure on record. On the other hand, US corporate ESG issuance has dropped as a proportion of broader US credit markets, which have grown. For instance, in the second quarter of 2024 investment grade sustainable-labelled issuance fell 7% compared with the same period in 2023, while the broader investment grade market issuance increased 23% over the same period. We suspect this is a trend that we will continue to see into 2025.

A broader mix of European corporates are issuing sustainable-labelled bonds too. While financials and utilities are still the largest issuers of green bonds, other sectors have increased their share, including industrials, real estate, technology, media and telcos. There’s also a good spread of issuance across maturities and credit ratings within investment grade debt.

We have seen a meaningful dispersion develop in interest rate expectations in Europe compared to the US and the UK, as weaker growth and concerns over the potential implications of US trade policy on growth were reflected in rate expectations. Given the high level of uncertainty on US trade and fiscal policy and ongoing political uncertainty in Europe, we think it will be crucial in 2025 to be nimble in our duration exposure to various markets as we get greater clarity on policy and their likely implications for interest rates.

Given the tight level of credit spreads we have increased the defensiveness in the portfolio for 2025, increasing our weight to sovereign/supranational debt and decreasing our allocation to high yield as we don’t generally see current spreads as sufficient compensation for the risk that continued elevated levels of rates will weigh on the fundamentals of issuers as interest costs rise as debt is refinanced.

David Coombs & Will McIntosh-Whyte, fund managers of the Rathbone Multi-Asset Portfolios and the Rathbone Greenbank Multi-Asset Portfolios

The shock of a comprehensive Donald Trump electoral win has worn off and attention has turned to his Cabinet picks. A new cottage industry has been founded to divine Trump’s likely policy paths through the medium of personnel.

The President-Elect is much more organised than last time. In early December all the main Cabinet positions have been announced and only three relatively minor posts of the executive branch were unannounced. Most require Senate approval, which takes longer than it should and is getting longer with every election. It could be deep into 2025 before the Cabinet is fully confirmed.

There are some eyebrow-raising choices, like WWE Wrestling co-founder Linda McMahon as Education Secretary and vaccine sceptic Robert F Kennedy Jr as Health Secretary. Keeping an open mind, some good may come from departments getting an infusion of completely different views. But there’s also the chance of mutual lack of respect leading to gridlock or bad outcomes. We will have to wait and see. It’s Trump, so it’s prudent to expect some good, some bad and some wild.

Perhaps the most important pick for investors is billionaire hedge fund CEO Scott Bessent as Treasury Secretary (the job currently held by former US Federal Reserve Chair Janet Yellen). While at iconic hedge fund Soros Fund Management, Bessent was on the trading team that “broke the Bank of England” in the early 1990s, by betting the pound would sink. It led to the unravelling of sterling’s peg to the German mark. We won’t hold that against him though. He’s an eminently qualified choice for the top finance job and – coincidence or not – US bond yields calmed down soon after the news. Many investors see Bessent as a restraining force for the administration, one that could smooth the sharp edges of other members.

He has discussed a “3-3-3” strategy: halving the federal budget deficit to 3% of GDP by 2028, growing the economy by 3% a year through deregulation and privatisation, and increasing US oil production by 3 million barrels a day. Hitting these targets could be a tough ask. Also, while the mood on economic growth has been muted, we really should point out that GDP has been rising at an average of 2.4% a year, including the pandemic years, since 2016 (it’s 2.55% excluding 2020 and 2021). That’s not bad, considering the lower-rate, lower-growth world we’ve been living in. The ability to juice growth further without refiring inflation is up for debate. Cheaper energy could be at least part of the answer but, once again, the US is actually already not the laggard it’s made out to be. Since 2009 when US oil production started rising again, it has added an average of 530,000 barrels a day each year.

The oil price has drifted lower in recent months, helped no doubt by this Trump team rhetoric about boosting production. There’s also the potential for calm in the Middle East and lower estimates of future demand given economic weakness in China and Europe. With the price of WTI back under $70, that’s nearing the breakeven level reported by the Dallas Fed’s latest survey of US drillers, which ranges from $60 to $70.

In short, Bessent’s 3-3-3 strategy may be more spin than real economic targets. But the direction of travel seems positive for the US economy: a focus on growth, tighter finances, less bureaucracy, more private enterprise and cheaper energy.

Overall, we think the US economy is in a good place. Households and companies look strong and are becoming more optimistic as the year closes out. Interest rates have room to fall if required to offset any weakness that may materialise. American stock prices, while not cheap, aren’t expensive either. Especially when you consider the growth opportunities many of them offer.

Our view on the UK and Europe is a bit different. GDP growth is slipping: Continental powerhouse Germany has been in recession in all but name for years; France is stumbling from one government to another with little prospect of solving severe fiscal problems, and the UK could be in recession after a year of steadily falling growth. Rates may fall faster than elsewhere in Europe in an effort to support the economy. However, the UK may not have that luxury if inflation continues to re-accelerate.

Finally, there’s always the chance of more big government stimulus in China. The world’s factory has been steadily slowing for years, but that decline has worsened noticeably since the pandemic. Several packages of economic support were forthcoming in 2024, without sustained success. More stimulus looks increasingly likely. The nation needs reform as well though: will 2025 be the year where China takes some bold steps to fix the heavy overhang from its burst housing bubble?

Alan Dobbie & Carl Stick, co-managers of the Rathbone Income Fund

Hopes that the new Labour administration would quickly prove a safe pair of hands faded through a summer of gloomy messaging and an Autumn Budget that dismayed business leaders and economists alike. One retailer we’ve spoken to recently said that it could deal with the rise in the National Living Wage or higher National Insurance Contributions or the introduction of new packaging taxes. But getting all of them together, all at once, was a terrific strain at this point in the cycle. Business will step back from making investment and employment decisions. And many worry that all the negative headlines are feeding through to nervous consumers. Rather than being pro-growth, could the Budget measures end up stifling any nascent recovery?

Our optimistic view is that the answer is ‘no’, although the government clearly hasn’t done itself any favours with British business. Many companies have strong balance sheets and are generating cash. Despite their grumbles, they’re in decent shape to deal with current challenges. The valuation argument for the UK market remains front and centre. Yes, of course, a lot can go wrong, but the UK’s low entry-point is the margin of safety absent on the other side of the Atlantic.

It remains too easy to disregard the UK economy as a loser in global terms. Firstly, the UK is not alone in experiencing weakening PMI data. Excluding the US, it’s a trend among developed markets. Despite the post-Budget bleating, our experience is that companies are generally positive. The UK market remains cheap, ignoring the fact that consensus estimates for UK GDP growth in 2025 and 2026 have actually risen, inflation and interest rates are coming down, and the housing market continues to recover.

These positives don’t include any immediate catalysts that might shake the UK market out of its relative funk. Nevertheless, for all the doom and gloom, UK stocks’ low valuations alongside the country’s decent economic health together make for an intriguing mix:

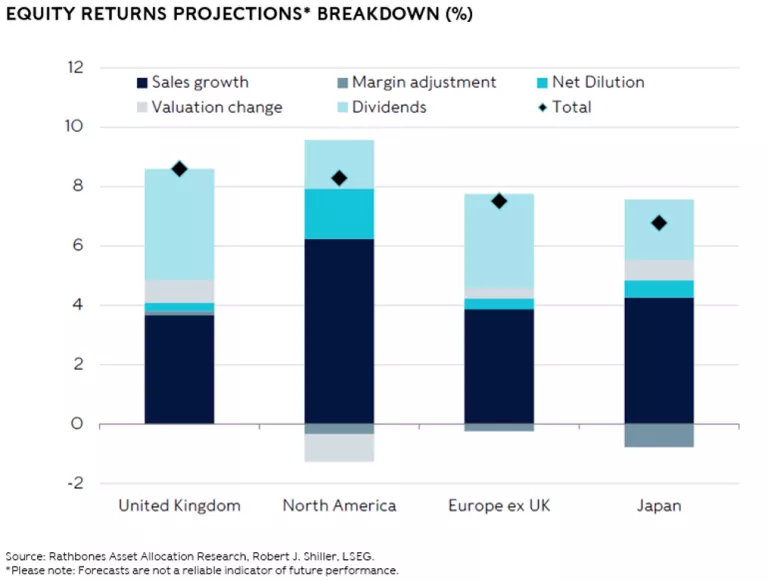

Yes, US companies will grow faster, but their scope for margin or valuation expansion is limited. Both are already stretched.

The Trump bounce takes very little account of how tariffs might impact global growth and US inflation, or how aggressive immigration policies could hurt US GDP growth (remember, population growth has been key in driving the latter), or the risk of government dysfunction. And, of course, there’s the crowding effect as more and more people pile into passive investment strategies that oblige them to buy more and more of the same shares. History tells us that, eventually, the elastic must snap.

Valuations in the US offer no safeguards at current levels. In the UK, the bad news is pretty well known and priced in. How comfortable you are with the risks that may lie ahead depends very much on your individual investment goals.

Ultimately, our biggest challenge may be relevance. At the moment, investors may look at the UK, recognise that it represents a small percentage of the global market, and conclude that it is not worth the effort. That conclusion is out of our control. However, our commitment is to emphasise repeatedly the importance of income strategies, and the opportunities within the UK market on account of the dividend yields and valuations on offer. For clients with demands for income and capital flexibility, the UK market jolly well should retain its relevance, and we must tirelessly champion that cause.