Document Library

| Factsheet | KIID |

| Interim report | Annual report |

| Holdings report | Monthly note |

| Quarterly note | Prospectus |

| Assessment of value | Fund brochure |

| Annual review 2024 | TCFD Report |

| SDR Consumer-Facing Disclosure |

For additional fund documents and share classes visit our literature library

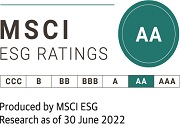

Awards and Ratings

|

|

|

|

Literature Library

Rathbone Greenbank Multi-Asset Dynamic Growth Portfolio - full fund holdings information

Download FileMeet the fund managers

DAVID COOMBS

Head of multi-asset investments

DAVID COOMBS

Head of multi-asset investments

David heads our multi-asset investments team, which manages the Rathbone Multi-Asset and Rathbone Greenbank Portfolio funds. He joined Rathbones in 2007 after spending 19 years with Baring Asset Management, where he managed multi-asset funds and segregated mandates. He began his career with Hambros Bank in 1984.

David heads our multi-asset investments team, which manages the Rathbone Multi-Asset and Rathbone Greenbank Portfolio funds. He joined Rathbones in 2007 after spending 19 years with Baring Asset Management, where he managed multi-asset funds and segregated mandates. He began his career with Hambros Bank in 1984.

Will McIntosh-Whyte

Fund manager

Will McIntosh-Whyte

Fund manager

Will manages the Rathbone Multi-Asset and Rathbone Greenbank Portfolio funds. He joined Rathbones’ charities team in 2007 and was made investment manager in 2011, running institutional multi-asset mandates. He has been with our multi-asset investments team since 2015 and a fund manager since July 2019. Will is a Chartered Financial Analyst (CFA) charterholder and graduated from the University of Manchester Institute of Science and Technology with a BSc Hons in Management.

Will manages the Rathbone Multi-Asset and Rathbone Greenbank Portfolio funds. He joined Rathbones’ charities team in 2007 and was made investment manager in 2011, running institutional multi-asset mandates. He has been with our multi-asset investments team since 2015 and a fund manager since July 2019. Will is a Chartered Financial Analyst (CFA) charterholder and graduated from the University of Manchester Institute of Science and Technology with a BSc Hons in Management.

In Conversation

Manager Will McIntosh-Whyte picks out some of the bigger drivers of his funds’ performance for 2024 so far. He discusses current positioning and how he and the team have been taking advantage of the recent volatility in bond markets. He tackles recent and upcoming elections, looking what the impact of a new US President might be. Finally, he explains where the team are finding exciting opportunities in the market.